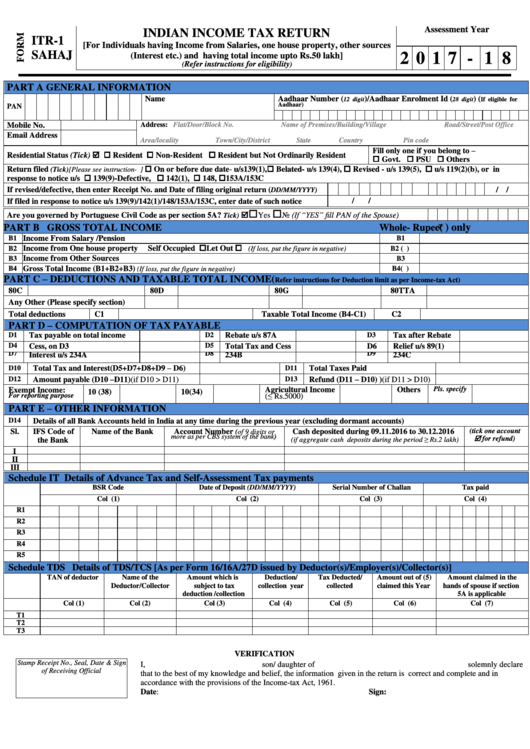

The return will be processed only upon receipt of signed ITR-V.Ī step-by-step guide to prepare and submit ITR online. If your ITR is uploaded with DSC, the return filing process is complete.Īlternatively, if the return is not uploaded with DSC, the ITR-V form should be printed, signed and submitted to CPC within 120 days from the date of e-Filing. This form will also be sent to the registered email. Step 7: Click on the link and download the ITR-V. Once the submission is completed, ITR-V will be displayed (in case DSC is not used). Make sure that the DSC is registered with e-Filing. Step 5: In the next step, upload Digital Signature Certificate (DSC), if applicable. Step 4: Now, go to e-File and click on 'Upload Return' and select the appropriate ITR, assessment year and XML file previously saved in Step 2.

Step 3: Log in to e-filing website with the user ID, password, date of birth and enter the given captcha code Step 2: Prepare the return using the downloaded software. Step 1: Download the ITR preparation software for the relevant assessment year to your system from the 'Downloads' page. Here is the step-wise process to upload ITR. According to the update on income tax India e-filing website, "ITR 1, 2, 3 and 4 for assessment year (AY) 2019-20 are now available for e-Filing. It may be noted that the ITR-1 and ITR-2 forms are now available on the e-filing website. Though the last date to file an income tax return for the financial year 2018-19 is July 31, 2019, but in order to avoid the last minute glitch, you can file your return online as well. If you have gathered all the required documents for filing an income tax return then you should not wait for the last date to file the return.

0 kommentar(er)

0 kommentar(er)